estate tax exemption 2022 build back better

Federal Estate Tax Exemption 2022 Federal Estate Tax Exemption in 2022. Here is what you need to know.

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

. As a result the gift estate and GST tax exemptions are each 117 million per person in 2021. What is the transfer tax exemption for 2022. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

Build Back Better Act. As of January 1 2022 the federal gift and estate tax exclusion amount as well as the exemption. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

3 version introduced an increase to the cap with a slightly higher. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. Under the TCJA the exemption is scheduled to decrease to 5 million adjusted.

The size of the estate tax exemption meant. The cumulative lifetime exemption increased to 12060000 in 2022 until after 2025 indexed for. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

Key Tax Concepts for 2022. Ad From Fisher Investments 40 years managing money and helping thousands of families. This of course could remain subject to change.

October 14 2020. The unified credit against estate and gift tax in 2022 will be. The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate.

The proposal reduces the exemption from estate and gift taxes from. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. In short the plan proposes to reduce the current federal gift and estate tax exemption from the 10 million indexed for inflation to 117 million for 2021 to 5 million.

Lower Estate Tax Exemption. As passed by the House on November 19 2021 the Build Back Better Act does not include these earlier proposals. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. The estimated 175 trillion bill.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Current Transfer Tax Laws. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The Build Back Better. This means starting in 2019 people are permitted to pass on tax-free 114. Lifetime Exclusion Increases to 12060000.

The tax-free annual exclusion amount has increased to 16000 in 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The current version of the Build Back Better Act does not appear to include this provision but until the Act is signed into law.

The Build Back Better bill passed in the House of Representatives on November 19 2021. The estate tax exemption is adjusted for inflation every year. As of January 1 2022.

Which allows a surviving spouse to use his. Under current law the estate and gift tax exemption is 117 million per person. The federal estate tax exemption amount is still dropping on January 1 2026 from.

5376 would revise the estate and gift tax and treatment of trusts. The Build Back Better Act passed by the House of Representatives last November ultimately did not include a number of provisions that had been of particular concern to estate planners. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The federal estate tax exemption for 2022 is 1206 million. You can gift up to the exemption amount during life or at death or some combination thereof. Estate and gift tax exemption.

Instead it contains three primary changes affecting estate and gift taxes.

2022 Updates To Estate And Gift Taxes Burner Law Group

The Build Back Better Act The Senate Bill True Partners Consulting

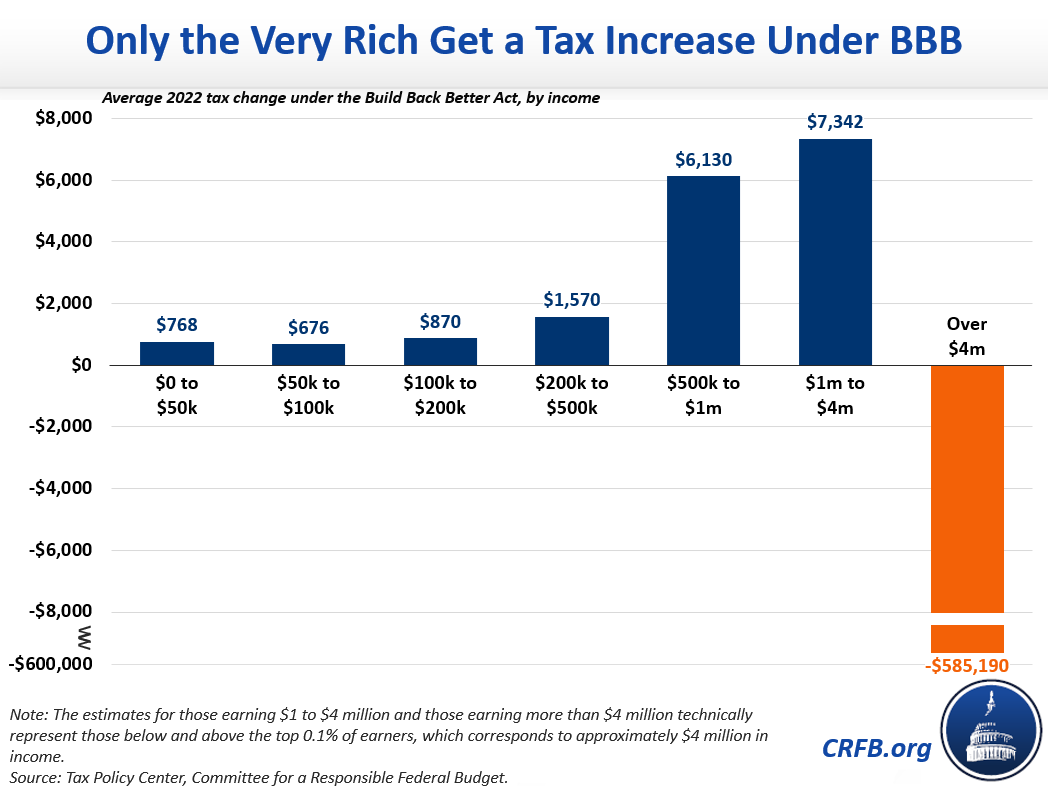

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Proposed Build Back Better Act Contains Key Tax Provisions Our Insights Plante Moran

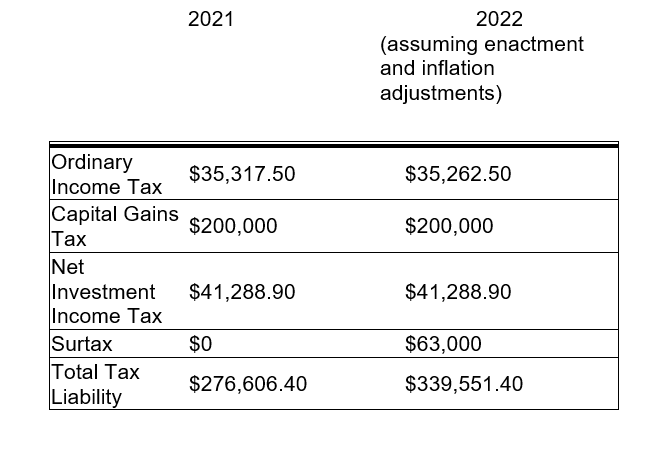

Two New Income Tax Surcharges Included In Build Back Better Act Wealth Management

Tax Proposals Under The Build Back Better Act Version 2 0

The Good And The Bad Build Back Better Act Individual Income And Estate Gift Tax Provisions Donorstrust

Build Back Better Inflation Impact Biden Tax Plan Tax Foundation

How Will Build Back Better Affect Qsbs Qsbs Expert

Why You Should Care About The Build Back Better Act

With A Smaller Build Back Better Here S What Aid Americans May Expect

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

How Will Build Back Better Affect Qsbs Qsbs Expert

Dems Just Snuck A Tax Cut For The Rich Into Build Back Better Bill

Use It Or Lose It Locking In The 11 58 Million Unified Credit

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

What Biden S Latest Build Back Better Plan Means For Older Adults